Montana Endowment Tax Credit

Special Opportunity for Montana Taxpayers – Qualified Endowment Credit

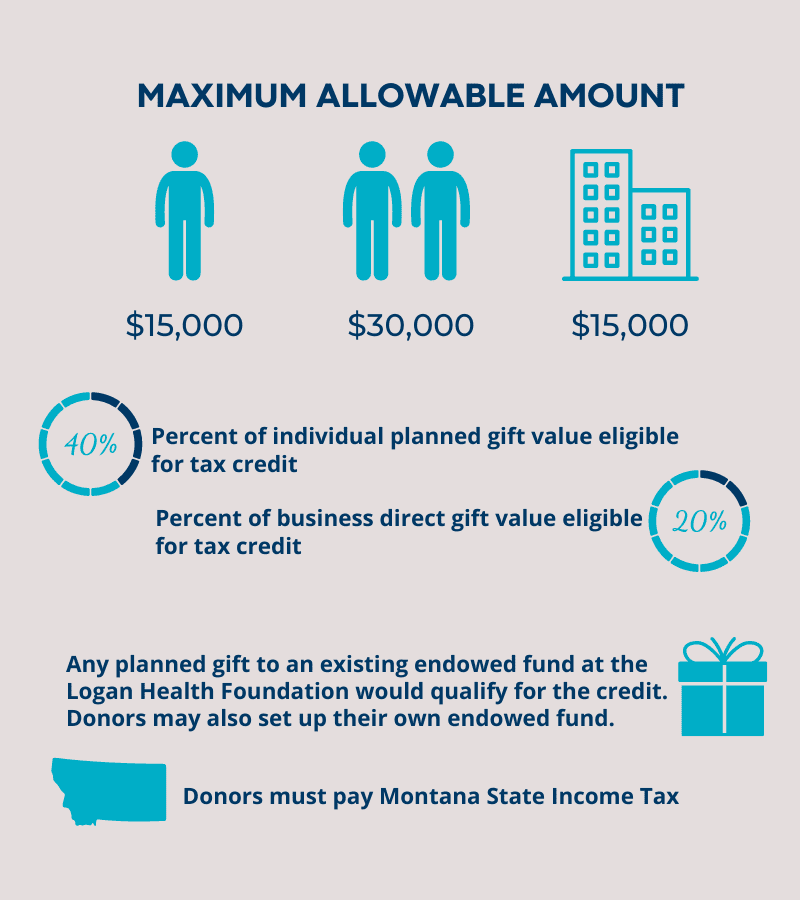

Important Update – Effective January 1, 2024, Senate Bill 506 increased the Qualified Endowment Credit limits to those noted below and also made the popular state tax credit permanent.

You have an opportunity to invest in the future of Logan Health and our community while receiving significant tax savings through a Federal deduction and a Montana state tax credit. For instance, a 50-year-old donor making a $10,000 planned gift could receive a $4,929 Federal tax deduction and a Montana tax credit of $3,286.

The deduction and the size of the Montana tax credit are dependent on the size of the gift and the age of the donor. The credit is 40% of the planned gift’s federal charitable deduction value, up to a maximum of $15,000 per individual or $30,000 per couple. For businesses, the credit is calculated at 20% of the value of the gift, up to a maximum of $15,000.

Any individual or business that pays income taxes to the State of Montana is eligible for the credit.

Which planned gifts qualify?

- Charitable Gift Annuities

- Deferred Charitable Gift Annuities

- Charitable Remainder Unitrusts

- Charitable Remainder Annuity Trusts

- Pooled Income Fund Trusts*

- Charitable Lead Trusts

- Charitable Lead Annuity Trusts

- Charitable Life Estate Agreements

- Paid-up Life Insurance Policies

What else do I need to know?

- The credit is only available in the year you make your planned gift. If you are unable to use the full credit in that year, there is no carry-forward or carry-back.

- The credit is non-refundable, which means that it cannot reduce your income tax liability to less than zero.

- You can take advantage of the Qualified Endowment Credit each year you make a qualified gift.

Gifts must be made to any endowed fund managed by the Logan Health Foundation, or the donor may use their gift as an opportunity to establish a new endowment.

For more information contact Michael Barth, Logan Health Foundation Director of Operations, at mbarth@logan.org or at 406-858-6881. More information about the credit and the form needed to claim the credit are available on the State of Montana’s website.

This site is informational and educational in nature. It is not offering professional tax, legal, or accounting advice. For specific advice about the effect of any planning concept on your tax or financial situation or with your estate, please consult a qualified professional advisor.